Financial management

Financial management process provides a financial view on the value of IT services and corresponding configuration items.

Outputs of this process enable organization to answer following types of questions:

- Which services cost most and why?

- What types and volumes of services do we have and what budget we want for them?

- Do we create services that are provided for market prices, reduce the risk and offer an added value?

- Where are the biggest opportunities for increasing service effectiveness?

Financial management process enables decisions, on which services the organization should focus with its own resources and which will be advantageous when purchased from third parties. The other output is a budget plan appropriate with the planned level (requests for equipment, way of working etc.) and volume of provided sevices (e.g. number of users).

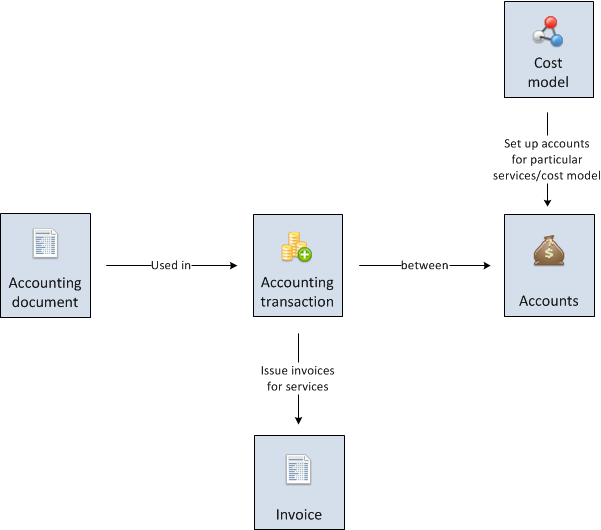

ObjectGears supports Financial management process by the help of Cost models entities, that are created for particular services. There is an Account assigned to each service (no matter if service provided to an end user or internal service within IT), to which direct cost related to the particular service and adequate share of indirect cost, that need to be shared among services according to a defined key, are allocated. Service hierarchy enables transfering cost associated with a service A to other services B,C..., if these services B,C... utilize service A. Foundation for cost allocation (Accounting transaction) is an Accounting document (e.g. invoice, internal calculation etc.).

Based on contracts with service recipients invoices may be issued (ITIL model Chargeback) or service recipients may be only informed about cost associated with services consumed by them.